In today’s consumer-driven society, understanding the psychology behind spending is more crucial than ever. With advertisers increasingly savvy in their methods and a myriad of psychological triggers at play, it’s easy to find ourselves spending more than intended. This article explores thirteen psychological tactics that can lead to overspending, providing insights to help you recognize and resist these often subconscious influences.

1. The Decoy Effect

The decoy effect is a pricing strategy that influences your choice between two options by adding a third, less attractive option. For instance, if you’re considering two subscription plans, a third, pricier plan can make the moderately priced option seem more appealing, even if it’s more than you originally intended to spend. This tactic exploits our natural tendency to seek comparative bargains, often leading to higher spending.

2. Social Proof

Social proof is the psychological phenomenon where people mimic the actions of others in an attempt to reflect correct behavior. When we see friends or influencers purchasing a new gadget or fashion item, we’re more likely to want it too, driven by a fear of missing out (FOMO). This can lead to purchasing items we don’t need, simply because others are doing the same.

3. Scarcity Bias

Items that appear scarce are perceived as more valuable, prompting us to buy quickly to avoid missing out. Retailers often use limited-time offers or limited-stock notifications to create a sense of urgency. This tactic plays on our innate fear of scarcity, pushing us to make hasty, and often more expensive, purchases.

4. Anchoring Bias

Anchoring bias occurs when we rely too heavily on the first piece of information we see. For example, seeing a $200 shirt marked down to $100 makes the $100 seem like a steal, regardless of the shirt’s true value. This strategy often leads us to overspend by creating an illusion of value tied to arbitrarily high original prices.

5. Payment Abstraction

The less we feel like we’re spending real money, the more likely we are to spend more. Credit cards, digital wallets, and mobile payments distance us from the physical act of handing over cash, making expenditures feel less ‘real.’ This abstraction can lead to higher and more frequent spending as the psychological pain of paying is diminished.

6. The Endowment Effect

We tend to value things higher once we own them, but this bias can also trick us into buying things we don’t need. Free trials and easy returns encourage purchases by initially removing the financial risk. However, once we feel ownership, we’re more likely to go through with the purchase, even if the item isn’t entirely necessary.

7. Instant Gratification

Our brains are wired to seek immediate rewards, a tendency that modern e-commerce taps into with one-click ordering and same-day delivery. This desire for instant gratification can lead to impulsive buys, as the long-term financial impacts are overshadowed by the immediate pleasure of obtaining something new.

8. The Halo Effect

The halo effect is when our overall impression of a brand (formed by marketing, product experience, or reputation) influences our decisions on additional purchases. If we have a positive experience with one product, we’re more likely to assume other products from the same brand are also worthwhile, sometimes leading to unnecessary spending.

9. Choice Paradox

While having options is appealing, too many choices can lead to anxiety and poor decisions. Retailers offering a wide array of products may overwhelm consumers, who then make hasty decisions that can result in regret and financial loss. Simplifying choices can help mitigate this effect and keep spending in check.

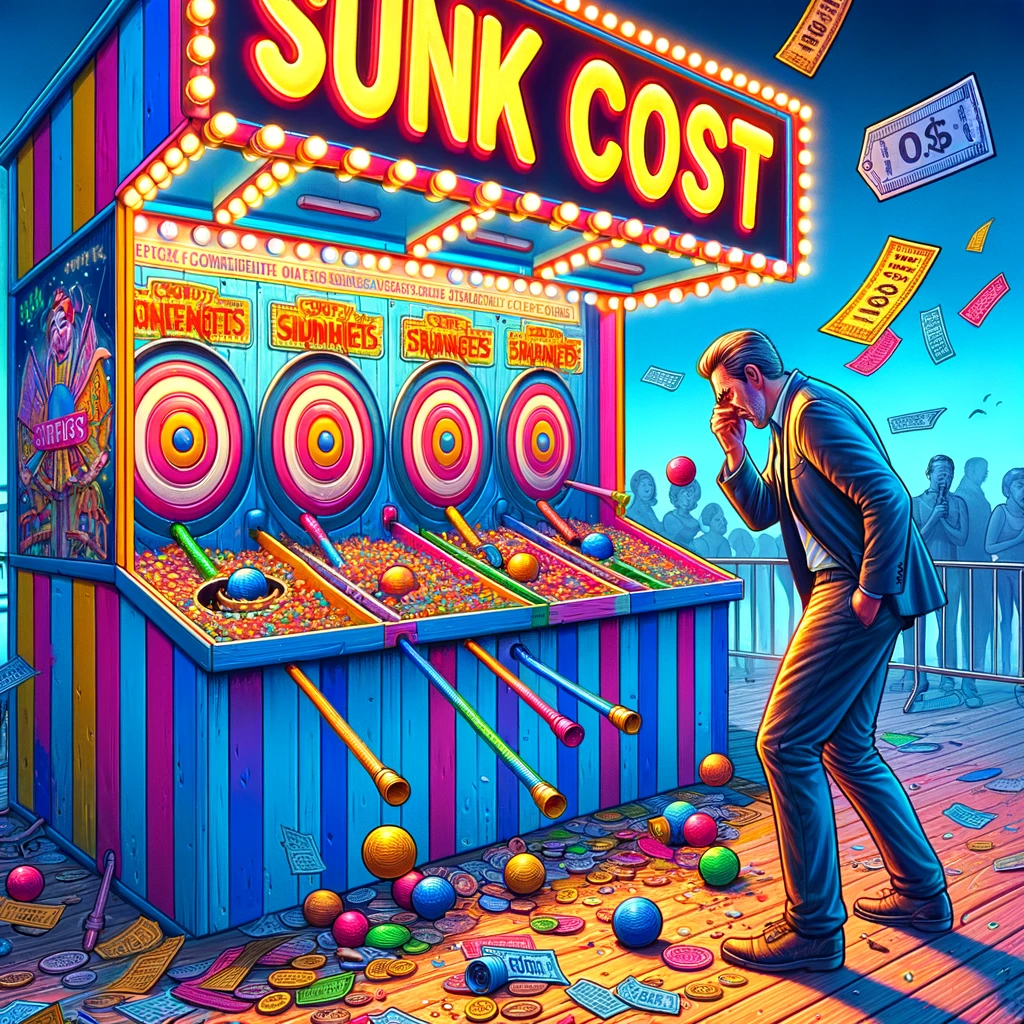

10. The Sunk Cost Fallacy

The sunk cost fallacy compels us to continue an endeavor if we’ve already invested time, money, or effort into it, even if the current costs outweigh the benefits. This can manifest in spending habits, such as continuing to invest in a product or service that no longer meets our needs, simply because we’ve already spent money on it.

11. Hyperbolic Discounting

Hyperbolic discounting occurs when we choose smaller, immediate rewards over larger, later rewards. This can lead to spontaneous and extravagant spending when faced with the opportunity for instant satisfaction, even if waiting could lead to better financial outcomes.

12. The Contrast Effect

This effect influences how we perceive the attractiveness of options when presented sequentially. If a high-priced item is shown first, a slightly cheaper item next to it will seem like a good deal, even if it is still expensive. Retailers manipulate this perception to make us feel we are getting a better deal than we actually are.

13. Emotional Spending

Lastly, emotions play a significant role in our spending habits. Sadness, stress, and even excessive happiness can prompt us to shop therapeutically. Understanding that our emotions can influence spending may help us think more critically about our purchases, especially in high-stress or high-emotion situations.

Learning Not to Overspend

Recognizing these psychological triggers is the first step toward smarter spending. By understanding the tactics retailers use to encourage overspending, consumers can develop strategies to counteract them, leading to more thoughtful and deliberate financial decisions.

Read More

12 Animal Training Techniques That Are Now Considered Inhumane by Experts

18 Unconventional Career Paths Embraced by Gen Z