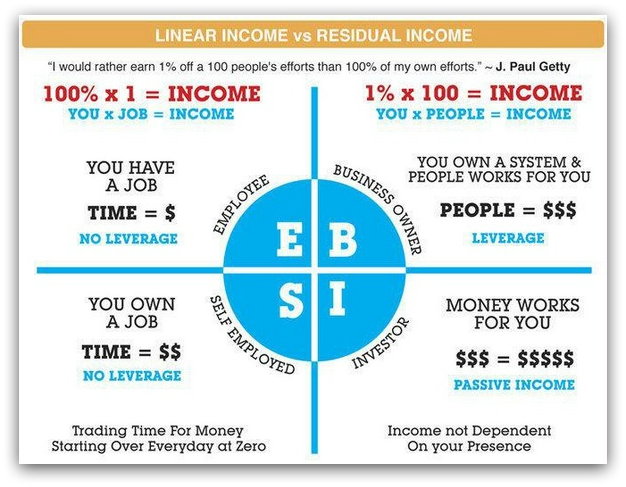

What Is The Cashflow Quadrant?

The cashflow quadrant was created by Robert Kiyosaki. Using the quadrant he was able to break down different career paths and help others visualize what makes each part of the business world attractive. It is separated into four parts (employee, business owner, self-employed and investor). The cashflow quadrant was published in 1996 (the second in Kiyosaki’s “Rich Dad, Poor Dad” series) and shows people who to work less and earn more but how does it work?

How To Read the Cashflow Quadrant

Any person who generates income can be found in at least one of the four sections of the quadrant. Where each person is is determined by where their income comes from. This is because in Kiyosaki’s thinking current income is the most important aspect of personal finance.

As mentioned above, there are four separate parts of the cashflow quadrant. These parts are labeled employee, business owner, self-employed and investor. They are represented by letters in the quadrant (E, B, S, I).

(E) Employee

Practically everyone starts out in the “E” section of the quadrant. This, as stated before, stands for employees. An employee is usually paid hourly or paid a salary. Employees are also generally looking for security in their job and there is much less “security” in the other three quadrants of Kiyosaki’s.

The typical way that most employees get more money is to find higher paying work. This is because typically employees receive a fixed wage for each hour they work, and there are limits on the amount of hours a given individual can work in a week.

(S) Self-Employed/Small Business/Specialist

The next quadrant is the self-employed quadrant. Becoming self-employed is a great decision for many people but it is not for everyone. Many people remain employees for the security but being self-employed can provide you with great freedom. You get to decide your schedule for the most part and you basically get to decide how much money you earn.

People in the self employed quadrant are typically attorneys, physicians, dentists or other high paying service professions. It can also include free lance writers or skilled tradepeople like plumbers or roofers. The category also includes small business people.

Usually when self employed people need additional cash, they look for ways to bill more hours. This is because they essentially trade their time for money. And there are market limitations on what self employed people can charge for their services. For example, a doctor can’t charge $1,000 for a check up if five other physicians will do the same work for $100.

(B) Business Owner/Big Business

Following the self-employed section of the quadrant are business owners. Business owners are similar to self-employed individuals in that they crave freedom but business owners crave both financial freedom and control over their time. The main difference between being a business owner and being self-employed is that, in theory, money a business owner earns doesn’t come from any work they did personally, instead they leverage the labor of others to provide goods and services.

Business owners, if successful, are generally able to yield larger rewards than people in the (E) employee quadrant as they are able to leverage the labor power of others.

Tax laws are also different, and generally more favorable for business owners.

(I) Investor

Lastly, you have investors. Anyone who doesn’t rely on their own work (or the work of others, in a business owner’s position) to earn money. People generally work their way up to the investors spot in the cashflow quadrant. You can also be an investor and continue belonging to other parts of the quadrant.

In general people in the investor quadrant want freedom. They achieve this by acquiring cash producing assets such as stocks, bonds rental real estate, oil wells or gold mines.

Any of these investment options will allow your money to make money for you.

What the Cashflow Quadrant Does

If you prefer an audio explanation of the basic concepts, here is an early video from Kiyosaki where he outlines what each quadrant means.

Well, the answer isn’t all that simple. The cashflow quadrant breaks down the flow of income and which businesspeople are more likely to make more cash than the others. It also provides you a basic understanding and a roadmap for understanding and improving your cash flow.

For example you can start in the employee quadrant, but move over to the investor quadrant by investing in cash producing assets over time. Or you can start in the employee quadrant, then start a business to move into the Self employed quadrant.

Finally, the Cashflow Quadrant is fully explained in Robert Kiyosaki’s book by the same name, Rich Dad’s CASHFLOW Quadrant: Rich Dad’s Guide to Financial Freedom. The book sells for something like 6 bucks on Amazon, so you might as well get a copy.

Finally, the Cashflow Quadrant is fully explained in Robert Kiyosaki’s book by the same name, Rich Dad’s CASHFLOW Quadrant: Rich Dad’s Guide to Financial Freedom. The book sells for something like 6 bucks on Amazon, so you might as well get a copy.

If you don’t want to drop the 6 bucks on Amazon, there is an audio version of the book floating around on Youtube. I found a copy here.

As always, if you are interested in starting any new business venture be sure to do your research before investing money or time.

Photo: Life Coach and Former Career Guy