Knowing your credit score is important. It impacts your ability to buy things and live your life the way you want. There are various credit ranges, usually characterized by the terms very poor, poor, fair, good and excellent. What about a 637 credit score? Is that a good credit score and what purchases will you be able to make if that is your score?

What are the Credit Score Ranges?

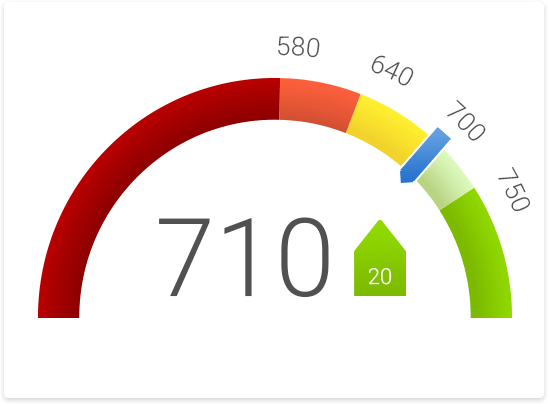

Credit scores range from 300 to 850 (this has changed in more recent years to allow higher credit scores for some). The ranges vary from credit report agency to credit report agency. However, the larger credit report agencies are Experian, Equifax, Transunion and FICO. Each company provides consumers a report with a credit score between 300 and 850. Eight hundred and above is considered to be elite, but what is a good credit score?

What is a Good Credit Score?

No credit score is made equal. Your score could be better (in the 600s) but you may have a serious mark on your record that will prevent you from getting a loan or buying a house. Either way, you’ll want to know what makes a good score.

Anything below 550 is considered to be “very poor” or bad. 550 to 649 is poor. 650 to 699 is fair. 700 to 749 is good, and anything above 750 is excellent. So, let’s say you have a 637 credit score. It doesn’t sound terrible, but it still lies within the “poor” range.

What Does a 637 Credit Score Mean?

Many lenders have a credit score range that they stick within when supplying loans or a line of credit. For instance, if you are looking for loan from a car company, they have a range of credit scores they are more likely to approve. Of course, this also depends on marks on your report. Some companies may approve anyone over 600. However, others may want a higher score.

A 637 credit score, as you know from above, is considered to be poor. What will you be able to do with a score like that?

- Can you buy a house with a 637 credit score? Probably. A conventional home loan generally requires a 620 credit score.

- Can you buy a car with a 637 credit score? You’ll likely be able to buy a car with any credit score, but you may need a co-signer or may have higher interest.

- Can you get a loan with a 637 credit score? Most likely. There are lenders who give people with bad credit loans. So, someone with a 637 credit score won’t have an issue finding one if they are in need.

- Can you get a credit card with a 637 credit score? Yes. You can get a credit card with a 637 credit score. In fact, getting a credit card can be a great way to help boost your score over time.

- Is 637 a good credit score? 637 is considered to be a poor score. However, the average credit score in the United States is 687. So, if you’re sitting at 637, don’t feel bad.

How to Improve Your Rating

Once you know what your credit score is, you can also figure out what factors are affecting it most. Once you identify the problem, you can take steps towards improving your score. It will take some time before you see much change, but these steps can help you improve a 637 credit score.

- Pay your bills on time. Creditors want to know if you are a reliable debtor and can pay your bills on time. Set up automatic payments and be sure to make all your monthly payments before their due dates. Not only will avoid late fees, but its also makes you look better to potential lenders.

- Consolidate your debt. If you are paying several bills each month, consider using a debt relief service to lower your monthly payments. They will work to get you lower interests rates to save you significant cash.

- Keep your credit card balances low. If you have several credit cards, the first thing you need to do is control your spending. You want to pay down your debt, not add to it.

- Don’t apply for new credit cards or lines of credit. It is also unwise to open any new credit accounts unless absolutely necessary. Too many hard inquiries can hurt your credit score and be counterproductive.

- Regularly check your credit reports. You should always have an idea of what your credit score is. All three reporting bureaus make your monthly credit report available to you. If you discover any discrepancies, you can dispute the errors. The sooner you take action against inaccuracies, the lower the chance it will affect your credit score.

Credit and credit scores can be a little overwhelming. If you have a 300 credit score, a 637 or an 850 it is always a good idea to stay on top of your score and work to keep it excellent (or work to get it there).

Have you raised your credit score in an unique way? We’d love to hear your story.

Photo: The Guarantors

Read More

- Your Credit Score: What It Means When You’re Applying For A Mortgage

- 11 Ways To Improve Your Finances and Credit Score in 2020

- Your Credit Score Matters More Than You Know

Jenny Smedra is an avid world traveler, ESL teacher, former archaeologist, and freelance writer. Choosing a life abroad had strengthened her commitment to finding ways to bring people together across language and cultural barriers. While most of her time is dedicated to either working with children, she also enjoys good friends, good food, and new adventures.