what's new

trending

7 Funeral Home Practices That Were Just Made Illegal

July 2, 2025

6 Billionaire Habits You Can Actually Adopt

June 12, 2025

10 Habits Keeping the Middle Class from Getting Rich

May 20, 2025

How to Avoid Raising Kids Who Are Financial Red Flags

April 22, 2025

These Money Fights Ruined Relationships—Here’s What to Avoid

April 16, 2025

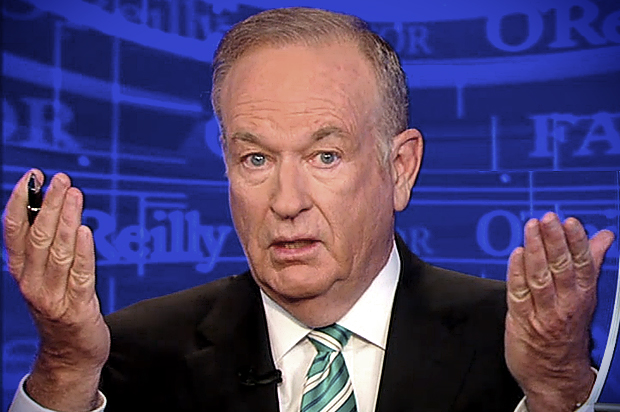

What is Bill O’Reilly’s Net Worth?

April 19, 2017

Tony Beets’ Net Worth

February 20, 2017

What is Jaclyn Hill’s Net Worth?

January 25, 2017

7 Financial Habits That Can Lead to Wealth

June 25, 2025

10 Habits Keeping the Middle Class from Getting Rich

May 20, 2025

12 Things You Shouldn’t Store on the Cloud

May 21, 2024

How Many Accounts Does It Take To Manage Your Finances?

October 11, 2023