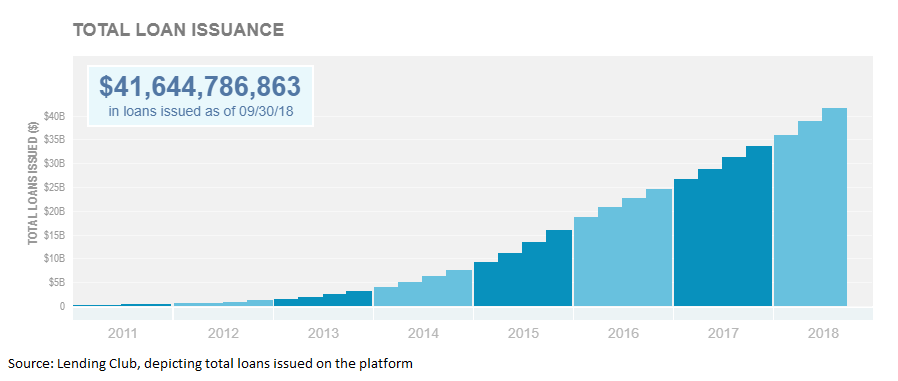

Over the past ten years, we’ve seen the rise of peer-to-peer lending. Prosper and Lending Club were the first to introduce this technology to link borrowers and investors. Peer lending has seen rapid growth since then, reaching $3.5B in funded loans by the year 2015. Throughout this time of rapid growth, one group of consumers has been easily forgotten; those who desire a short-term payday loan to meet their needs for emergency cash until their next paycheck. Unfortunately, this is a group of consumers that has been completely disregarded by major creditors throughout the history of online lending.

Online Lending: A Brief History

Starting in the 1990’s, many unscrupulous online lenders established themselves in order to serve these borrowers by hosting their operations in countries outside of the jurisdiction of local, state, tribal, and federal governments. Sadly, the vast majority of these lenders used questionable practices to trap borrowers in a cycle of debt. These lenders would charge renewal fees that would deceive borrowers into believing they were paying down the loan principle, or threaten borrowers with arrest if they weren’t able to pay. When it’s all said and done, consumers with less-than-stellar credit history will still be attracted to these lenders because they’re desperate for a payday advance. In short, borrowers with a history of poor credit or bankruptcy will still seek out forms of credit regardless of the risks.

Peer-to-Peer Lending for California Payday Loans

There is a lender that is seeking to shake up the industry. USA Express Loans is a California-based and licensed lender that envisioned the need to democratize the issuance of loans in the subprime short-term lending space. They’re in the process of developing a peer-to-peer network specifically for payday loans. Their objective is to use a peer-to-peer platform to connect non-institutional personal investors with borrowers who need cash. Borrowers will use a simple form that will take no more than a few minutes to enter their information. USA Express Loans will undergo an initial underwriting check in real-time that will verify their name, income, job, and other information to guard against fraud. After borrowers get through this screening (it all happens instantly), their request will be listed on a dashboard where investors will have the ability to browse. Investors will be able to see non-sensitive or identifying information on any given loan request, such as the job title, monthly income, DTI, and other details to assist their decision on what rate they want to lend their money at. In a few seconds, an investor will be able to fund an entire loan, or a small part of a loan in order to diversify their risk.

There are a number of logistics and legal obstacles that must be overcome before this platform can come to life. USA Express Loans’ Chief Technology Officer, Jeffrey Martinez, explained that they are going to work with the California Department of Business Oversight, the Securities Exchange Commission, the Consumer Financial Protection Bureau, and the Community Financial Services Association of America to ensure their system passes muster on all fronts.

Online Lending: The Future

Many people believed that Lending Club and Prosper were the furthest we’d ever see of a practical application for peer-to-peer lending. The reality is that the market for peer-to-peer lending is vast and has great potential. Many unexplored aspects of peer-to-peer lending exist. Companies such as USA Express Loans are opening these markets to the benefit of both investors and borrowers. Sharp investors should stay abreast of the exciting new technology in this growing space.