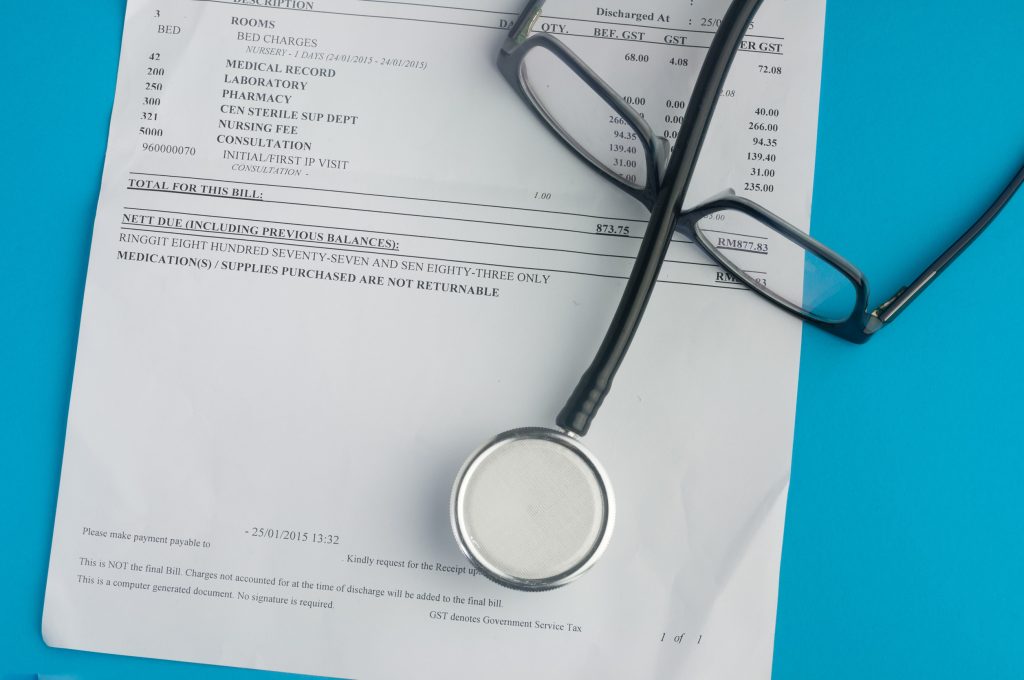

A medical crisis can strike at any moment, and the bills that follow can be overwhelming. For many, unpaid medical bills are a source of stress and anxiety, but they often feel like a manageable problem that can be negotiated or paid down over time. However, there is a critical turning point where a medical bill transforms from a simple debt into a powerful legal judgment. When a healthcare provider or a collection agency takes you to court and wins, the consequences can be severe and long-lasting. It’s at this moment that medical bills that become permanent debt can haunt your financial life for years, if not decades.

Here are six ways a medical bill can be legally cemented as a long-term financial burden.

1. When a Hospital Sues and Wins a judgment

If you have a large, unpaid hospital bill, the provider may choose to file a lawsuit against you. Many people ignore the court summons, assuming they can’t afford a lawyer or that there’s nothing they can do. If you don’t show up to court, the hospital will almost certainly win a “default judgment.” This court order is a legal declaration that you owe the debt. A judgment is valid for many years (often 10 years or more, depending on the state) and can usually be renewed, making the debt effectively permanent until it is paid.

2. When Unpaid Bills Are Attached to Your Property via a Lien

Once a creditor has a court judgment against you, they can take further steps to secure the debt. One of the most powerful tools is a property lien. The creditor can file the judgment with the county records office, which attaches the debt to any real estate you own in that county. This means you cannot sell or refinance your home without first paying off the judgment from the proceeds of the sale. The medical debt is now directly tied to your most valuable asset.

3. When a Court Orders Wage Garnishment

A court judgment also gives the creditor the right to petition the court for a writ of garnishment. If granted, this order is sent to your employer, who is then legally required to withhold a certain percentage of your paycheck and send it directly to the creditor. This can be up to 25% of your disposable income, depending on state law. Wage garnishment can continue until the entire judgment, including interest and legal fees, is paid in full, making it a forced, long-term payment plan you have no control over.

4. When Medical Debt Isn’t Discharged in Bankruptcy

While filing for bankruptcy is a way to discharge many unsecured debts, including most medical bills, it’s not always a clean slate. Certain types of medical debts, particularly those that were deemed to have been incurred through fraudulent means, might not be dischargeable. More commonly, if a creditor has already placed a lien on your property before you file for bankruptcy, the lien may survive the bankruptcy process. This means that while you may no longer be personally liable for the debt, the lien remains on your property and must be dealt with eventually.

5. When You Sign a Confession of Judgment

In some states, a creditor might ask you to sign a document called a “Confession of Judgment” as part of a payment plan. This is a legal document where you admit liability and waive your right to a defense in court. If you default on the payment plan, the creditor can immediately go to court and obtain a judgment against you without ever having to serve you or prove their case. Signing one of these documents is essentially pre-authorizing a lawsuit against yourself and should be avoided at all costs.

6. When the Debt Is Sold to a Third-Party Collector Who Sues

Often, the original hospital or clinic will sell its unpaid debts to a third-party debt buyer for pennies on the dollar. These debt buyers are often much more aggressive about litigation. They may sue you over a relatively small debt, hoping you won’t respond so they can get an easy default judgment. Once they have that judgment, they have all the legal tools of a regular creditor, including the ability to garnish your wages and place liens on your property.

From a Health Crisis to a Financial Judgment

The journey from a simple medical bill to a legally enforceable judgment is a path that too many Americans are forced down. It highlights the critical importance of addressing medical bills proactively, before they end up in the legal system. Communicate with the provider, negotiate a payment plan, check for financial assistance programs, and never, ever ignore a court summons. Once the gavel falls, medical bills that become permanent debt can create a financial hole that is incredibly difficult to escape.

What is the most confusing or frustrating part of dealing with the medical billing system?

Read more:

10 Health Insurance Hacks Everyone Should Know

7 Insurance Clauses Hidden in Your Mortgage You’ll Regret Ignoring

Latrice is a dedicated professional with a rich background in social work, complemented by an Associate Degree in the field. Her journey has been uniquely shaped by the rewarding experience of being a stay-at-home mom to her two children, aged 13 and 5. This role has not only been a testament to her commitment to family but has also provided her with invaluable life lessons and insights.

As a mother, Latrice has embraced the opportunity to educate her children on essential life skills, with a special focus on financial literacy, the nuances of life, and the importance of inner peace.