what's new

trending

Who is Richer? Democrats or Republicans?

February 23, 2024

Make Money by Selling on Craigslist

February 19, 2024

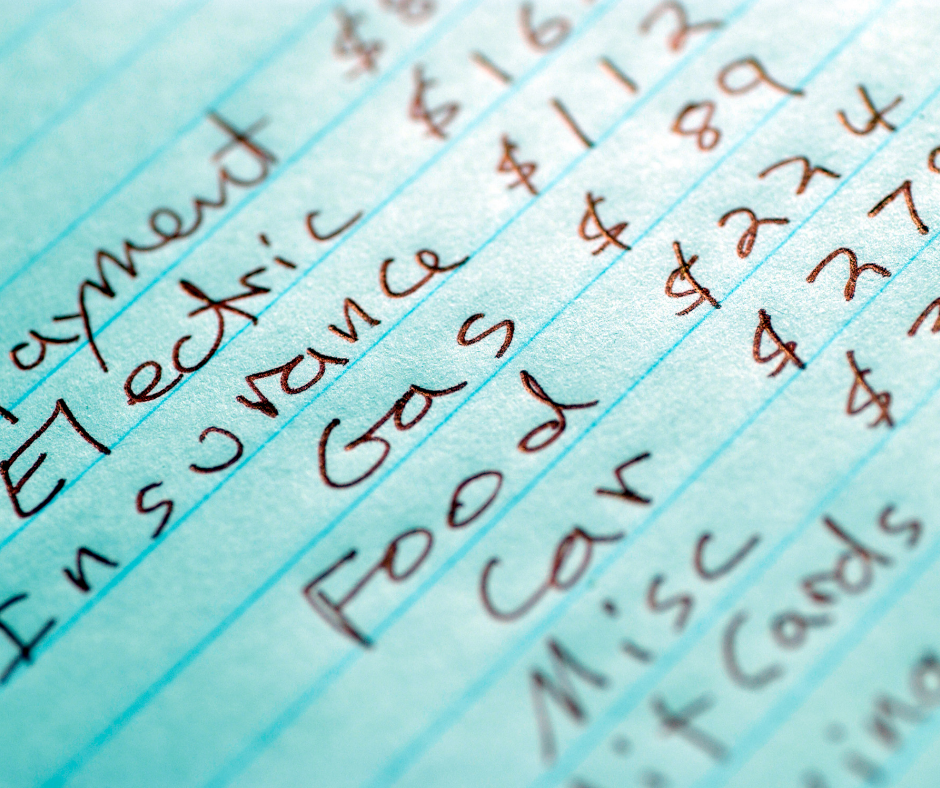

How to Budget on an Irregular Income

December 28, 2023

This 26-Week Money Challenge Will Help You Save $5,000 Next Year

October 24, 2023

How To Get Your Rent Deposit Back

October 20, 2023

Visa Signature or Visa Platinum?

October 13, 2023

Credit Score Ranges: What Can a 637 Credit Score Get You?

October 13, 2023

Jimmy Tatro’s Net Worth

October 15, 2023

Joey Graceffa’s Net Worth

September 12, 2023

Celebrity Net Worth After Winning An Oscar

September 26, 2019

The High Cost of Cheap Living: How Bargain Hunting Can Backfire

February 28, 2024

How To Get Your Rent Deposit Back

October 20, 2023

7 Ways to Involve Friends in Saving Money

December 2, 2020

Can You Save $1000 a Month?

September 27, 2018

Budget Exercise: How to Get Fit For Free

September 5, 2018

How Many Accounts Does It Take To Manage Your Finances?

October 11, 2023

It’s Time for Some Financial Spring Cleaning

May 6, 2019